Paramount's True Value: Beyond Media Speculation

- Emon

- Apr 16, 2024

- 3 min read

Updated: Apr 17, 2024

Paramount Global, formerly ViacomCBS, is a diversified media conglomerate with Paramount Pictures at its core, alongside subsidiaries like Paramount Television Studios, Paramount Animation, and Paramount Home Entertainment. Showtime offers premium content, while CBS delivers popular TV programs and news. Paramount Plus, the flagship streaming service, combines content from Paramount Pictures, CBS, Showtime, and others for a comprehensive entertainment experience. Through strategic alliances and innovative distribution, Paramount Global ensures diverse content access, maintaining its reach in the global entertainment industry.

PARA (the B shares specifically) have seen wild fluctuations in price, from trading over 23 dollars in mid-2023, to now hovering at 10.43 a share. The company is worth 7.2B with over 29B in sales for 2023. Although Paramount has many financing costs (they have approximately 13B in debt) and has been operating at a loss for 2023; analysts expect the company to post over 1B in net income for 2024. Management recently indicated they expect domestic profitability for paramount plus by 2025.

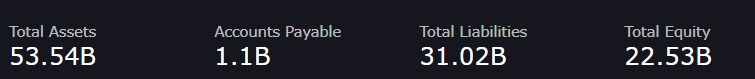

To dig deeper into the value of para, let's look at their balance sheet (more in-depth analysis of specific categories on the balance sheet is excluded for time purposes):

To express in simple terms, the company has 22.5B in Assets net of Liabilities (total equity, which is assets - liabilities), Which translates to a book value per share of around 33 Dollars.

So why would a company be trading at 31% of its book value and around 7 times its expected net income for next year? A combination of factors played into this extremely cheap stock; here is the oversimplified timeline of the last few months:

Byron Allen offered 21.53 per B share (this deal with the inclusion of debt is worth 30B) at the beginning of the year

Apollo offered 11B for the Paramount Studio (one of Paramount's assets, considered its crown jewel).

Sheri Redstone the owner of 30M PARAA (A shares, which have voting rights) out of the 40M total; does not want to sell to just anyone, she wants David Ellison to buy her stake and apparently "carry on her father's legacy?".

Right after Skydance and Paramount entered exclusivity talks, it was reported that Apollo offered a preliminary bid of 26B (including debt) which comes out to around 19 dollars a share.

The media has released details and multiple negative stories on the potential deal and outlined it would be dilutive to shareholders. Paramount would purchase Skydance for 5B and the two would trade publicly.

Multiple large shareholders have publically opposed the Skydance deal and threatened to sue (Matrix and Barrington Capital) if the board votes to go through with the deal.

4 Board members have announced they are leaving just 2 weeks into these talks.

Despite most of the media constantly implying B shares are worthless because of the potential dilution, I decided to take a look at the off-exchange volume to gauge institutional accumulation and distribution on Paramount and because of the other offers on the table, I reviewed the legal precedent surrounding matters like this:

Off-exchange trade Imbalances (The net buying or selling of a stock that took place):

3 Week Imbalance: 15,923,792 Buy-side

(2.44% of the outstanding was net bought through the dark pools)

3 Month Imbalance: 52,282,922 Buy-side

(8.0% of the outstanding was net bought through the dark pools)

In summary, significant amounts of paramount are being bought over what was sold through the off-exchange in recent times.

When reviewing the legal precedent behind situations like these it's hard to miss: "Revlon, Inc. v. MacAndrews & Forbes Holdings, Inc." In this case, the court held that in the event of a sale of the company, the board's primary obligation shifts from the general duty of care to maximize shareholder value. Instead, it becomes an obligation to secure the best available price for shareholders. This case set a precedent for corporate governance and the responsibilities of boards of directors during takeover situations, emphasizing the importance of fairness and transparency in corporate transactions. Applying this particular case to the paramount situation leads me to believe whether Sheri wants it or not, the board and company are going to be forced to pursue other more lucrative offers unless David Ellison at Skydance makes the merger terms more appealing.

In conclusion, while the Paramount situation is tricky and there are plenty of factors at play, I believe there is not going to be a better time to be positive on the stock's outlook. The company is priced extremely cheap, has had large amounts of institutional buying, and is positioned for a bottom-line turnaround coming into this year. Not only does Paramount have multiple bidders for over a 90% upside from this price, but it also has a solid fundamental case and a related legal precedent protecting shareholders from a potentially hostile and dilutive merger.

Miscalculation or misrepresentation?